Here we can see the beginning balance of its retained earnings (shown as reinvested earnings), the net income for the period, and the dividends distributed to shareholders in the period. Retained earnings are an important part of accounting—and not just for linking your income statements with your balance sheets. Retained earnings are a critical part of your accounting cycle that helps any small business owner grow their business. It’s the number that indicates how much capital you can reinvest in growing your business. For example, if you’re looking to bring on investors, retained earnings are a key part of your shareholder equity and book value. This number’s a must.Ultimately, before you start to grow by hiring more people or launching a new product, you need a firm grasp on how much money you can actually commit.

Retained Earnings in Accounting and What They Can Tell You

- And it can pinpoint what business owners can and can’t do in the future.

- Retained earnings refer to the historical profits earned by a company, minus any dividends it paid in the past.

- This, of course, depends on whether the company has been pursuing profitable growth opportunities.

- You can also move the money to cash flow to pay for some form of extra growth.

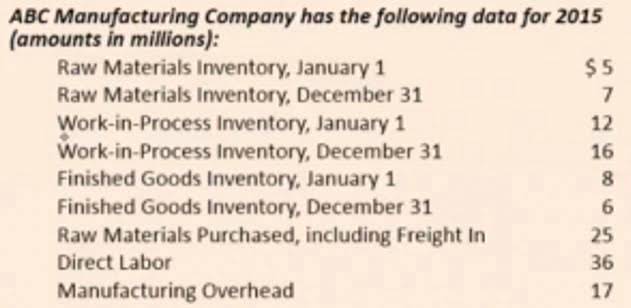

- These include revenues, cost of goods sold, operating expenses, and depreciation.

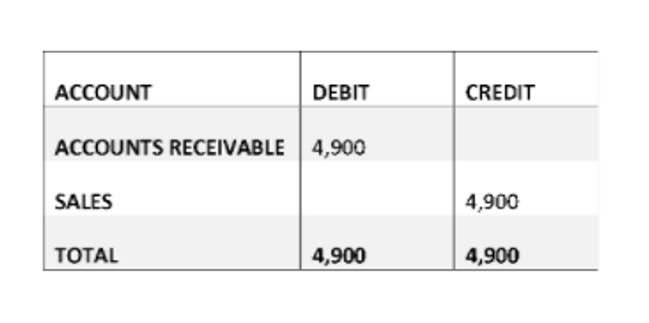

- When a company generates net income, it is typically recorded as a credit to the retained earnings account, increasing the balance.

A statement of retained earnings consists of a few components and takes a series of steps to prepare. For instance, a company may declare statement of retained earnings example a $1 cash dividend on all its 100,000 outstanding shares. Accordingly, the cash dividend declared by the company would be $ 100,000.

Resources for Your Growing Business

You can also finance new products, pay debts, or pay stock or cash dividends. Rather, it could be because of paying dividends to shareholders, capital expenditures, or a change in liquid assets. It might also be because of different financial modelling, or because a business needs more or less working capital.

How to prepare a statement of retained earnings

A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial statements), which can be found in the company’s annual report or website. These earnings are considered “retained” because they have not been distributed to shareholders as dividends but have instead been kept by the company for future use. Retained earnings are calculated by subtracting a company’s total dividends paid to shareholders from its net income.

These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt. A company reports retained earnings on a balance sheet under the shareholders equity section. It’s important to calculate retained earnings at the end of every accounting period. Instead, they reallocate a portion of the RE to common stock and additional paid-in capital accounts. This allocation does not impact the overall size of the company’s balance sheet, but it does decrease the value of stocks per share.

- You can either distribute surplus income as dividends or reinvest the same as retained earnings.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- Profits give a lot of room to the business owner(s) or the company management to use the surplus money earned.

- This statement is primarily for the use of outside parties such as investors in the firm or the firm’s creditors.

- On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years.

They need to know how much return they’re getting on their investment. It’s often the most important number, as it describes how a company performs financially. Revenue and retained earnings are crucial for evaluating a company’s financial health.

- With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike.

- The statement of retained earnings is also known as a statement of owner’s equity, an equity statement, or a statement of shareholders’ equity.

- This is the amount of retained earnings to date, which is accumulated earnings of the company since its inception.

- For instance, in the case of the yearly income statement and balance sheet, the net profit as calculated for the current accounting period would increase the balance of retained earnings.

- The statement of retained earnings is also important for business management as it allows the firm to determine its retention ratio.

- Remember to interpret retained earnings in the context of your business realities (i.e. seasonality), and you’ll be in good shape to improve earnings and grow your business.

Spend less time figuring out your cash flow and more time optimizing it with Bench. Once your cost of goods sold, expenses, and any liabilities are covered, you have to pay out cash dividends to shareholders. The money that’s left after you’ve paid your shareholders is held onto (or “retained”) by the business.

Lenders are interested in knowing the company’s ability to honor its debt obligations in the future. Lenders want to lend to established and profitable companies that retain some of their reported earnings for future use. Even if the company is experiencing a slowdown in business activities, it can still make use of the retained earnings to pay down its debt obligations. The beginning equity balance is always listed on its own line followed by any adjustments that are made to retained earnings for prior period errors. These adjustments could be caused by improper accounting methods used, poor estimates, or even fraud.

Paying the dividends in cash causes cash outflow, which we note in the accounts and books as net reductions. You can learn more about FreshBooks by visiting their official website. One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value. It is calculated over a period of time (usually a couple of years) and assesses the change in stock price against the net earnings retained by the company.

Leave a reply