Businesses of all sizes have been trusting us with their payroll for over 70 years. Our payroll experts streamline your payroll, paying your people accurately, on time and ensuring compliance obligations are met. Depending on how much control you want to retain, you can opt for partially or fully managed models. Being able to respond to market and environmental changes is where HR can shine. ADP payroll enables your HR team to access data reporting that provides insight into how to prepare for the future – through improved development of employees, talent retention and accurate pay runs.

- Outsourcing can also save you time from having to manage HR yourself while helping to ensure compliance and accuracy.

- Using payroll outsourcing companies can save you time and money so you can focus on growing your business.

- Our 2024 guide takes you through the ins and outs of how payroll outsourcing works and how your company can best evaluate a possible outsourcing strategy.

- “Leaving it to the pros” can be especially beneficial for large companies with complex and burdensome payroll responsibilities.

Best Practices for Outsourcing Payroll

Alternatively, this person or group won’t work directly for the provider, but will have the access they need to run payroll. By outsourcing payroll, small businesses can save money on the cost of setting up and managing their own payroll system, and then paying an employee such as a payroll specialist to manage it. A payroll software or service can help you save time, reduce errors, boost security and stay compliant. However, if you’re planning to leverage the many benefits of hiring in different countries, you may want to opt for a payroll provider that can easily accommodate that. Things can change fast and pivots can happen, but you don’t want to be locked into an agreement with a provider that can’t grow with you.

Paychex HR Library

Workday gives you the ability to reconfigure your processes as often as you need to, so you can change as your needs change. Workday also incorporates payroll, workforce management, spend management and talent management. Human resources outsourcing (HRO) allows businesses to delegate HR duties to a third party, either in part or in total.

Are there any disadvantages to HR outsourcing?

Lisa has over 20 years of corporate human resources, legal operations and start-up experience, including executive roles in cybersecurity and building services industries. As the chief people officer of SkOUT Cybersecurity, Lisa was a member of the Executive Leadership Team. During her tenure, she collaborated with senior leadership to develop the company’s culture.

Why would I want ADP to process payrolls for me?

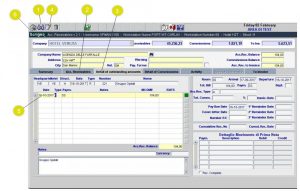

If you decide to use ADP as your provider, you can customise the payroll services you outsource, choosing either to partially retain control of some aspects, or to opt for fully managed. accounting for uncollectible accounts receivable They can be accountants or bookkeepers, or specialist payroll companies. Some providers may be better at dealing with small payrolls, while others target big businesses.

About MarketWatch Guides Team

For those who have managed payroll through Excel or Google Sheets, this system will make sense to you. Paycor offers a testing account with sandbox data, and I found the system interface to be clean and intuitive to navigate. In my testing, I found that Paychex Flex offers a clean interface.

While it pales in comparison to the payroll software capabilities of competitors like Rippling, BambooHR and ADP, its services are arguably more personalized. This is because Bambee adapts its service needs to your business by assigning you a dedicated HR manager who creates payroll procedures unique to your business. As another major player in the HR and payroll space, ADP’s offerings are narrower in focus than Rippling’s, but they gain in depth what they lose in breadth. Perhaps the most comprehensive HR and workforce management provider in the list, Rippling is a juggernaut in the industry (and rightly so).

When collecting state unemployment insurance or wage garnishments, you need to use their Enhanced Payroll plan. You also need this mid-tier plan to write a paper check or offer prepaid payment cards too. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content to guide you in making the best decisions for your business journey. You can extend the collection of funds from your bank account for up to seven days without interruption of services or extra fees with the help of our protection service, Paychex Promise®2. Always be plugged into the latest payroll information, employment law changes, and best practice information. This compliance tool can help keep you informed while you mitigate risk. Compare and choose the package that fits your unique needs – because payroll isn’t one size fits all.

All other states must remit payment and file their taxes themselves and so will pay a lower monthly base rate for Wave’s payroll solution. In addition, if you own a seasonal business and only need payroll software during parts of the year, you can deactivate your subscription for off-seasons and avoid paying Wave during that time. Then, when your business season kicks back in, simply reactivate your subscription and account. This capability, coupled with its contract payment options, makes Wave an ideal option for seasonal businesses such as garden centers and landscaping companies. Through Wave Payroll, you can pay employees and contractors via direct deposit and automatically generate W-2 and 1099 forms for tax season. It takes care of payroll tax payment and filing in 14 states (and growing), and offers a self-service employee portal for easy access to tax documents and banking and contact updates.

Outsourced payroll services are more than a solution to this challenge. They represent a commitment to operational excellence, so every team member receives their well-deserved earnings without delay. This approach is about more than just efficiency; it’s about building trust, enhancing morale, and fostering a workplace culture where employee satisfaction and retention are not just goals but realities. https://www.simple-accounting.org/ This proactive step not only streamlines financial processes but also reinforces the message that your organization values and respects its employees’ financial stability and peace of mind. In this handy guide, we’ll run through all the advantages of outsourcing payroll services and provide all the info you need to make a seamless switch to a better way of getting your people paid.

For instance, a tight-knit company experiencing overnight growth might not be prepared — or even know how — to compensate new employees fairly. An objective third party, however, won’t fall for favoritism or ethical https://www.accountingcoaching.online/flexible-budget/ dilemmas, because the right provider determines that with a merit matrix that rewards employees for performance. Correcting any of these factors after submitting payroll can require a costly fix or a steep penalty.

Leave a reply